REV Trader Pro

Should it stay or should it go now?

With apologies to The Clash and their 1982 song, Should I stay or Should I go now.

- Introduciton

- Balance results

- Monte Carlo results

- Minimum number of trades simulation

- Minimum deposit simulation

- Profit factor

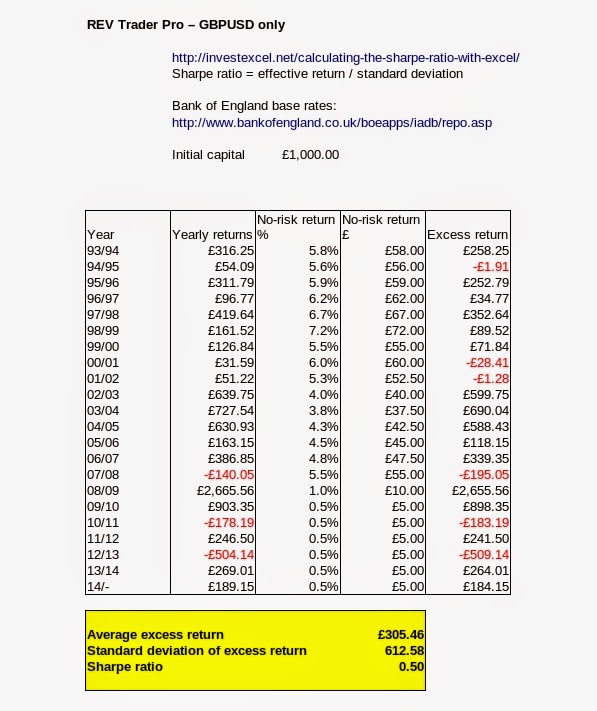

- Sharpe ratio

- GBPUSD with Money Management

- Conclusion

- Further edits

1. Introduction

REV Trader Pro is an

EA that works on

MetaTrader 4. It is the first EA I have purchased for MetaTrader.

I have been evaluating it over the last week, and am typing up my conclusions here as a method of crystallising my own thoughts as to whether I wish to trade with it or not. If my thoughts are of use to anyone else, then that's good too!

The first thing to note about REV Trader Pro is that its very difficult to do a long term back test on it. Indeed at the time of purchase, the author hadn't provided any. His reply to my enquiry why was that, "Because i'm showing live results, back tests are pretty much the same if you run it." (Sic.)

His live results from December 2013 till now may be found here, at

myfxbook.com. Currently they look like this:

|

| Image taken from myfxbook.com |

Profit factor is 2.70, and Sharpe Ratio is 0.21.

As I alluded above, back testing is an issue. To run one for the period January to October 2014 on GBPUSD took 15 hours. Given that I wished to back test all of the four pairs REV Trader Pro trades from 1993 till now, I reckoned that would take minimally 1635 hours, or at least two and a quarter months.

Clearly this wasn't a good idea, not least as that exceeds the refund policy period, but also that I need my computer during that time!

Then I found a post by Antny on

myfxbook.com in which he said that he'd achieved a reasonable back test using the "Control Points" method, rather than the "Every tick" one in MetaTrader back tester. He further stated that he'd "noticed there was virtually zero difference in the resultant trades." He also helpfully provided some charts, which at the time of writing are still available on myfxbook.com.

Therefore, using data from AlpariUK, I ran a test to compare January to October 2014 GBPUSD on both methods. I chose GBPUSD as it seemed to give the best chance of a profitable result, as reported by Batchboy here -

myfxbook.com:

|

| Jan to Oct 2014, every tick model |

|

| Jan to Oct 2014, control points model |

Based on my results obtained in the MetaTrader 4 back tester, shown above, I decided that the similarity was good enough to progress with long term back testing of REV Trader Pro. In considering this, I also took into account that the data I'd be using runs from 1993.3 to 2014.8, a period of 21.5 years, which I hoped would also serve to smooth out differences.

2. Balance results

I therefore ran individual back tests on the four currency pairs REV Trader Pro is designed to work on, AUDUSD, EURUSD, GBPUSD, and NZDUSD. I utilised the standard inputs, as provided by REV Trader Pro in the ".set" files for each pair, with only one change: ECNMode=false. This is because the Alpari account I'm using is a spread bet one, and is not an ECN brokerage account. These used a fixed 0.5 lot trade. Using a low fixed lot is generally a good idea in back tests, as anything else can hide dangerous flaws.

I then combined and analysed the results using

MTReport 4.0. At a cost $15, this is a tool all traders should have in their box. For detailed explanations of the charts and tests MTReport generates, see their manual, which you can download without charge

here.

The following chart shows the combined results of all four of the currency pairs over the 21.5 year period:

|

| Balance summary 1993 to date, AUDUSD, EURUSD, GBPUSD NZDUSD date intervals approximate |

Where the line turns red indicates where the points of maximum relative draw-down have occurred. Therefore, in the chart above, this is between the two red lines.

This chart begs the question, why the massive 40% down period? If you'd been trading this over that time, you'd have considered the EA to be broken, or the markets to have evolved - again! It would be safe to predict you would not have started using this EA again now.

It also seems to show that the authors of REV Trader Pro got lucky. They started their live results test right at the time the down period ended, when a major upturn seems to be in place.

This doesn't look like real consistency. How would we know if we were in an extended draw-down period, or just a blip?

The next four charts show the results for the individual currency pairs:

|

| Balance summary 1993 to date, AUDUSD date intervals approximate |

|

| Balance summary 1993 to date, EURUSD date intervals approximate |

|

| Balance summary 1993 to date, GBPUSD date intervals approximate |

|

| Balance summary 1993 to date, NZDUSD date intervals approximate |

These four charts tell different stories, with some commonality:

- broadly, the balance in all four has been increasing in 2014, coinciding with the test period published by the authors;

- AUDUSD and EURUSD have been largely sideways trading over the 21 years;

- NZDUSD has been a loss for fourteen of the the last 21 years;

- GBPUSD has been the only consistent winner, with only a minor balance down-trend in 1995, when it made its maximum relative draw-down.

3. Monte Carlo results

|

| Monte Carlo simulation AUDUSD, EURUSD, GBPUSD NZDUSD |

- Perfect - in only 11.2% of the simulated outcomes does the balance remain above the initial deposit;

- Error rate - 1.2% is low, since the simulations were based on 5000 days;

- Risk of ruin - there is an 80.7% risk of incurring 15% draw-down;

- Draw-down - 15.1% is the average draw-down;

- Deviation - a measure of the distance between the maximum and minimum balance for all trades, 124.5%;

- Profit/trade - the calculated average profit per trade;

- Balance - the average ending balance of all the simulation runs, £2478;

- Return - the average return percentage for all simulation runs, 147.8%.

Let's contrast this with the same for GBPUSD only:

|

| Monte Carlo simulation GBPUSD |

And now, using the GBPUSD back test results which produced the Jan to Oct 2014, every tick model balance/equity chart at the start of this article:

|

| Monte Carlo simulation GBPUSD |

GBPUSD looks more inspiring. The combined result, trading as per REV Trader Pro, doesn't.

4. Minimum number of trades simulation

This MTReport tool indicates the minimum number of trades needed before the return will exceed the draw-down experienced:

- GBPUSD = 1

- NZDUSD = 13

- EURUSD = ~ (stopped after 320, which could equate to around 3.8 years)

- AUDUSD (failed to provide any data - average profit from trade is negative)

GBPUSD is in the lead.

5. Minimum deposit simulation

This MTReport tool indicates the minimum deposit you'd need to maintain in an account to safely trade REV Trader Pro against each of the four currency pairs:

- GBPUSD min. deposit =624

- NZDUSD min. deposit = 8226

- EURUSD min. deposit = 9053

- AUDUSD (failed to provide any data - average profit from trade is negative)

Again, GBPUSD is in the lead by a country mile.

6. Profit factor

Profit factor = gross profit / gross loss:

- GBPUSD

- Gross profit = 25257.03

- Gross loss = 17687.91

- Profit factor = 1.43

- AUDUSD

- Gross profit = 9658.94

- Gross loss = 10519.23

- Profit factor = 0.92

- EURUSD

- Gross profit = 22976.81

- Gross loss = 22908.66

- Profit factor =1.00

- NZDUSD

- Gross profit = 17804.82

- Gross loss = 17220.43

- Profit factor =1.03

...and guess what? GBPUSD again.

7. Sharpe ratio

No surprise that the Sharpe ratio for GBPUSD by itself is better than all four pairs traded. A Sharpe ratio of nearer 1 is always the goal.

8. GBPUSD with Money Management

Trading GBPUSD only, and using the Control Points model, risking 3% per trade.

|

| Jan to Oct 2014 data - Balance, GBPUSD only |

|

| Jan to Oct 2014 data - Monte Carlo simulation, GBPUSD only |

The minimum number of trades needed before the return will exceed the draw-down experienced remains at 1.

The minimum deposit to maintain in an account to safely trade GBPUSD reduces to 551.

Profit factor using this profile is now 1.58.

Sharpe ratio = 0.32.

9. Conclusion

REV Trader Pro seems to promise a lot. But I'm not convinced of its longer term delivery.

When trading a system I would expect it to be robust over the long term. How does one discern between a permanent or long-term breakdown of performance and short-term draw-down? I don't think REV Trader Pro has proven its case here.

In addition, I don't understand the inclusion of AUDUSD, EURUSD, and NZDUSD. Yes, they seem to be in a short-term up-trend, but if my history data is correct, that will end sometime soon.

REV Trader Pro seems to be one of the more expensive EAs to buy. I'm not convinced it will meet expectation.

Even increasing the initial deposit from 1000 to 5000, and trading 3% risk in the money management section of the EA, there is no marked improvement in performance:

|

| REV Trader Pro, Jan to Oct 2014, GBPUSD only, 3% risk in money management |

I'm going to ask for a refund under the 60 day guarantee.

Then I'm going to see if I can design a GBPUSD EA myself using the excellent

fxDreema. Highly recommended. A non-programmer's delight, well worth the $95 annually. There are shorter periods too, e.g., monthly at $19, or free for an unlimited reduced functionality trial - and no, I don't get a commission!

I consider this the best of its kind on the market. If you are serious about trading, get your hands dirty without actually having to fully understand MQL4/5.

10. Further edits

4 Nov 2014, 18:14 GMT

Useful feedback from John on

eareview.net suggested I'd missed something:

John

...have you ever considered that the vendor optimizes it every year? Your using settings, that you hope will work for 20 years, is kind of naive and ridiculous. The markets always change and REV Trader PRO is clearly designed for the recent market of about past 2 years maybe longer. And I”m sure the vendor will provide updates further along.

Me

Yes. True, and I should have said that. I’d rather rely on me being around for 20 years to optimise my own EA, than relying on someone else. After all, the vendor’s interest in me only extends to the initial sale.

There again, the vendor’s current setting for GBPUSD *have* lasted for 20 years, and it is the GBPUSD pair that REV Trader Pro seems to rely on for profits!

So, with due respect to you, I think I’ll keep to my opinion. But thank you for the comment. I’m going to include it in my text.